Are they still calling for a military coup against Obama?Newsmax. No wonder you're so ignorant and misinformed.

GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

- rstrong

- Captain

- Posts: 5889

- Joined: Thu Oct 25, 2012 9:32 am

- Location: Winnipeg, MB

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

- O Really

- Admiral

- Posts: 23884

- Joined: Tue Sep 18, 2012 3:37 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

Good analysis of what's really happening... http://www.nj.com/us-politics/index.ssf ... _talk.html

- Stinger

- Sub-Lieutenant

- Posts: 1944

- Joined: Sun Sep 23, 2012 10:18 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

That was funny.rstrong wrote:Are they still calling for a military coup against Obama?Newsmax. No wonder you're so ignorant and misinformed.

You should listen to Michael Savage telling how Obama's going to do away with the 22nd Amendment and run again in 2016. (Gingrich buddy Porter Stansberry already sent out an e-mail to that effect on Nov. 1st.)

I'm guessing that's probably when he'll do away with the 2nd Amendment and take everyone's guns.

- Colonel Taylor

- Marshal

- Posts: 994

- Joined: Mon Sep 17, 2012 8:51 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

So what did Clinton raise the capitol gains taxes by, oh yea he lowered them, you forgot to mention that, by what was it 8 or 10 percent. Wasn't there a thing called the child tax credit that also lowered taxes, isn't that a loop hole you always whine about. Was it the tax relief that improved revenue after the lousy outcome of the 1993 tax hikes that made the Clinton economy successful. Lowering the capitol gains taxes caused investment to triple by 98 and double by 99. This was caused by TAX CUTS.

The libs whined that the tax cuts would reduce revenue when it in fact it it increased them, hence the vrede twist and lib talking points about taxes.

The libs whined that the tax cuts would reduce revenue when it in fact it it increased them, hence the vrede twist and lib talking points about taxes.

Vrede wrote:That's not the only funny thing about it.O Really wrote:I notice that a goal of Republicans has been met - George W Bush no longer exists, at least according to the Wall Street Journal.... funny... http://nymag.com/daily/intel/2012/11/ge ... picks=trueClinton, who raised taxes, saw the economy outperform Reagan's, who cut taxes, 5 years out of 8 with 1 tie. So, even if they remove Shrub to deceptively make a point, they still don't make the point.The Wall Street Journal editorial page today, having previously recognized the hopeless lack of leverage in budget negotiations, takes to pleading with President Obama not to raise taxes because it will harm growth. The editorial is accompanied by this helpful chart showing what the Journal editorial considers some important historical lessons of recent two-term presidents. Look at the chart very closely:

No George W. Bush! Possibly there wasn't enough room. Or possibly the lesson of the most recent former president, whose tax cuts are set to expire and who presided over poor economic growth, might not offer the lesson the Journal editorial page is seeking to convey.

Not that facts, even from Murdoch's WSJ, will ever sway cons from their dogma.

One other thing, the chart commits a fallacy that we've discussed here often. The first year of a presidency by rights should be credited more towards the predecessor. Policy takes awhile to have an effect. I'm not sure what this would do for Bill and Reagan, but the WSJ's obvious intent is to blame Obama for Shrub's impact.

- Stinger

- Sub-Lieutenant

- Posts: 1944

- Joined: Sun Sep 23, 2012 10:18 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

No, the dot com bubble did that. Cling to your rightwing mythology, though.Colonel Taylor wrote:Was it the tax relief that improved revenue after the lousy outcome of the 1993 tax hikes that made the Clinton economy successful. Lowering the capitol gains taxes caused investment to triple by 98 and double by 99. This was caused by TAX CUTS.

-

Reality

- Wing commander

- Posts: 485

- Joined: Mon Oct 15, 2012 4:39 am

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

"..that lying is so common, so reflexive, that we are literally unaware of the steady stream of falsehoods we utter."

http://www.huffingtonpost.com/pamela-me ... d%3D240280

I sent this to Obama but haven't got a response.

http://www.huffingtonpost.com/pamela-me ... d%3D240280

I sent this to Obama but haven't got a response.

- Stinger

- Sub-Lieutenant

- Posts: 1944

- Joined: Sun Sep 23, 2012 10:18 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

He already knows what a steady stream of falsehoods you utter. The NSA keeps him informed.Reality wrote:"..that lying is so common, so reflexive, that we are literally unaware of the steady stream of falsehoods we utter."

http://www.huffingtonpost.com/pamela-me ... d%3D240280

I sent this to Obama but haven't got a response.

He's also unaware how utterly unimportant you are.

- Bungalow Bill

- Ensign

- Posts: 1340

- Joined: Tue Sep 25, 2012 8:12 pm

- Location: Downtown Mills River

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

Clinton raised the top income tax rates and revenue went up. It ain't rocket surgery.

- Wneglia

- Midshipman

- Posts: 1103

- Joined: Tue Sep 18, 2012 7:00 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

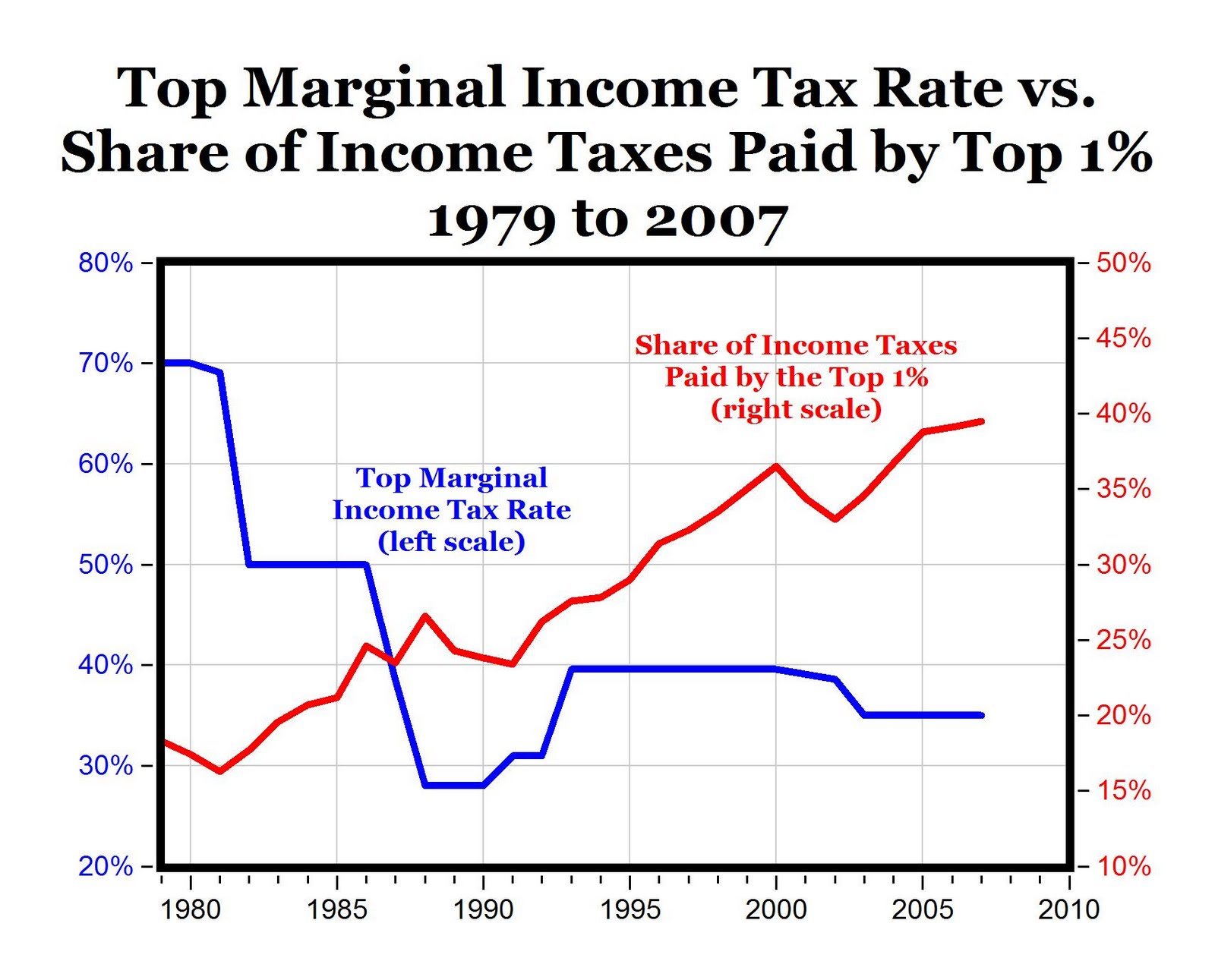

That's true, it ain't rocket surgery. Rates go down, revenues go up:Bungalow Bill wrote:Clinton raised the top income tax rates and revenue went up. It ain't rocket surgery.

Link

and we 1%'ers pay more.

- rstrong

- Captain

- Posts: 5889

- Joined: Thu Oct 25, 2012 9:32 am

- Location: Winnipeg, MB

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

He only raised the top income tax rates by a small, token amount. They were still MUCH LOWER than they were under Reagan. And that was offset by tax cuts for lower-income families and small businesses.Bungalow Bill wrote:Clinton raised the top income tax rates and revenue went up.

Nice try though.

- Stinger

- Sub-Lieutenant

- Posts: 1944

- Joined: Sun Sep 23, 2012 10:18 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

1%-ers pay more because they're the only ones making more.Wneglia wrote: That's true, it ain't rocket surgery. Rates go down, revenues go up:

Link

and we 1%'ers pay more.

The graph shows percentage of taxes paid, not increased federal revenues.

The increases in federal revenues coincide with the dot com and housing bubbles, largely caused by artificially-low interest rates.

Then the bubbles crash, the middle class takes the hit, and the 1%-ers go right back to getting wealthier while the middle class and poor get poorer.

- rstrong

- Captain

- Posts: 5889

- Joined: Thu Oct 25, 2012 9:32 am

- Location: Winnipeg, MB

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

er, No.Wneglia wrote:and we 1%'ers pay more.

Payroll taxes went up as corporate and excise taxes went down.

Now, the company I work for pays for my internet line because I use it for work. They pay for my cell phone because I use it for tech support and developing mobile web sites. In the past I've written off part of my house expenses because I have a home office. One of these days I'll visit a trade show - in a city where I've been wanting to take a vacation - and write it off as a business expense. But few in the middle or low incomes do this.

The 1%'ers - who can afford tax accountants - do it on a much larger scale. Cars, trips, computer equipment, apartments in other cities, restaurants, you name it, even paying for services like the tax accountant, all paid for by the company. Often it's thier own personal company, which pays corporate tax rates, while they work for another company.

The 1%'ers share of income taxes has gone up only because while everyone else has gotten slightly poorer over the last generation, the 1%'ers have gotten much, much richer. They're still getting that income taxed at a much lower rate than a generation ago, and they've enjoyed having their personal expenses - taxed at corporate rates - taxed at a much lower level.

- Bungalow Bill

- Ensign

- Posts: 1340

- Joined: Tue Sep 25, 2012 8:12 pm

- Location: Downtown Mills River

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

Not exactly. The lowest top tax rate under Reagan was 28%, which is obviously lower than

39.6%. The 28% rate was raised to 31% during the Bush I administration, then to 39.6%

under Clinton, an increase of 25%, not a token amount.

39.6%. The 28% rate was raised to 31% during the Bush I administration, then to 39.6%

under Clinton, an increase of 25%, not a token amount.

-

Reality

- Wing commander

- Posts: 485

- Joined: Mon Oct 15, 2012 4:39 am

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

I didn't send this to the Vred and Dingle but I did get a response. Wonder why?

"..that lying is so common, so reflexive, that we are literally unaware of the steady stream of falsehoods we utter."

http://www.huffingtonpost.com/pamela-me ... d%3D240280

I sent this to Obama but haven't got a response.

"..that lying is so common, so reflexive, that we are literally unaware of the steady stream of falsehoods we utter."

http://www.huffingtonpost.com/pamela-me ... d%3D240280

I sent this to Obama but haven't got a response.

- O Really

- Admiral

- Posts: 23884

- Joined: Tue Sep 18, 2012 3:37 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

I wrote to the Queen to say I thought Corgis should grow tails. I didn't get a response. I wonder why.

- Bungalow Bill

- Ensign

- Posts: 1340

- Joined: Tue Sep 25, 2012 8:12 pm

- Location: Downtown Mills River

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

I should have made it clearer I was responding to rstrong, who used the word token to

describe the Clinton tax rate increases, which I think went beyond just token. Effective

tax rates are more important, as is the consideration of all types of taxes. Marginal tax

rates are easier to figure out if you're pressed for time.

describe the Clinton tax rate increases, which I think went beyond just token. Effective

tax rates are more important, as is the consideration of all types of taxes. Marginal tax

rates are easier to figure out if you're pressed for time.

- Bungalow Bill

- Ensign

- Posts: 1340

- Joined: Tue Sep 25, 2012 8:12 pm

- Location: Downtown Mills River

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

Hey, shit happens.

- rstrong

- Captain

- Posts: 5889

- Joined: Thu Oct 25, 2012 9:32 am

- Location: Winnipeg, MB

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

Let's add some context here. The top tax rate when Reagan entered the White House was 70%, down from 90% a little over a decade earlier. Bumping it from 31% back up only to 36%/39.6% is indeed a token amount.Bungalow Bill wrote:Not exactly. The lowest top tax rate under Reagan was 28%, which is obviously lower than 39.6%.

- Wneglia

- Midshipman

- Posts: 1103

- Joined: Tue Sep 18, 2012 7:00 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

Some more context: Before and under Reagan, there were so many legal tax shelters available that virtually nobody paid the highest marginal rate. I remember one year back then when my taxable income was reduced by almost 90% through tax shelters, and even though those extremely high marginal rates existed, I paid almost no income tax. Reagan did away with those loopholes and dropped the marginal rates, and revenues went up.rstrong wrote:Let's add some context here. The top tax rate when Reagan entered the White House was 70%, down from 90% a little over a decade earlier. Bumping it from 31% back up only to 36%/39.6% is indeed a token amount.Bungalow Bill wrote:Not exactly. The lowest top tax rate under Reagan was 28%, which is obviously lower than 39.6%.

- Stinger

- Sub-Lieutenant

- Posts: 1944

- Joined: Sun Sep 23, 2012 10:18 pm

Re: GOP Rejects Obama Offer of $1.6 Trillion Tax Increase

So, Reagan raised taxes -- I believe his words were "everyone pays their fair share" -- and revenues went up.Wneglia wrote:Some more context: Before and under Reagan, there were so many legal tax shelters available that virtually nobody paid the highest marginal rate. I remember one year back then when my taxable income was reduced by almost 90% through tax shelters, and even though those extremely high marginal rates existed, I paid almost no income tax. Reagan did away with those loopholes and dropped the marginal rates, and revenues went up.rstrong wrote:Let's add some context here. The top tax rate when Reagan entered the White House was 70%, down from 90% a little over a decade earlier. Bumping it from 31% back up only to 36%/39.6% is indeed a token amount.Bungalow Bill wrote:Not exactly. The lowest top tax rate under Reagan was 28%, which is obviously lower than 39.6%.